Investing in a bank is a common practice to earn interest on savings, and it is often believed that large banks offer lower interest rates compared to smaller finance banks. However, there is a concern among investors regarding the safety of their investments in small finance banks. In this article, we will explore the safety of fixed deposits (FDs) in small finance banks and provide insights on how to achieve higher returns with 100% safety for your money.

The Deposit Insurance and Credit Guarantee Corporation (DICGC) is a subsidiary of the Reserve Bank of India (RBI) and is responsible for providing deposit insurance to depositors in Indian banks. DICGC provides a level of protection to depositors by insuring their deposits in case of bank failure.

Under the DICGC scheme, each depositor is insured up to a maximum of ₹5 lakh (including principal and interest) in commercial banks, including small finance banks. This means that if a bank fails and is unable to repay its depositors, DICGC steps in and reimburses the insured amount to the depositor.

It’s important to note that the DICGC coverage is per depositor and not per account. This means that if you have multiple accounts in the same bank, including different branches of that bank, the insurance coverage will still be limited to ₹5 lakh in total, regardless of the number of accounts you hold.

To ensure the safety of your bank deposits up to ₹5 lakh, follow these steps:

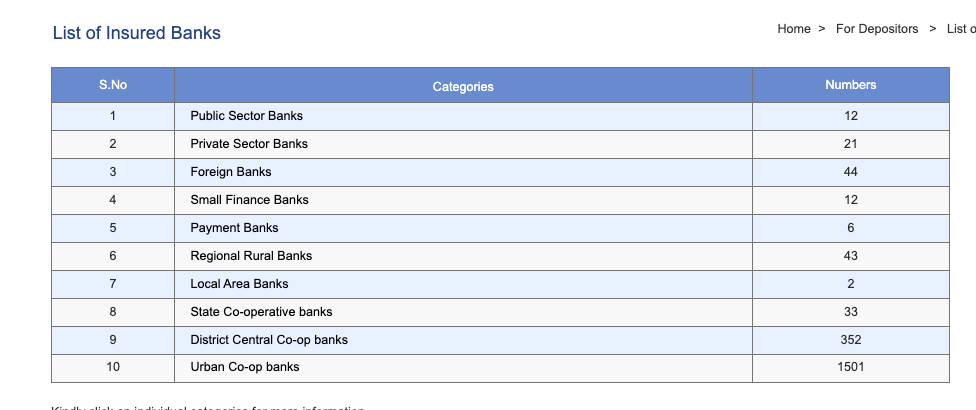

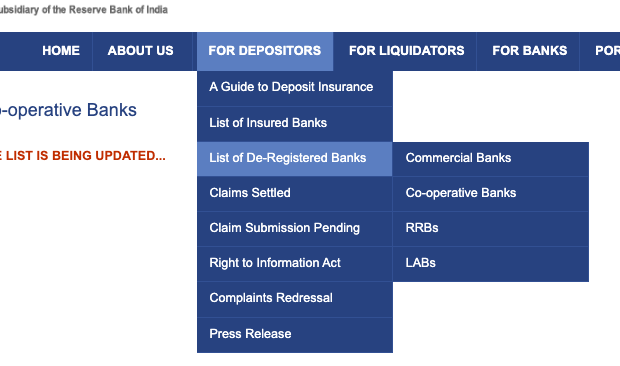

- Visit the DICGC website by clicking on the following link: DICGC List of Insured Banks.

- On the website, navigate to the section for small finance banks.

- Open the PDF document provided for small finance banks. List of current insured small finance bank

- Check if the bank you are planning to deposit your funds with is listed in the document. If it is listed, your investment up to ₹5 lakh, including the principal amount and interest, is insured.

- For additional safety you can withdraw your interest on monthly or quarterly basis.

- It is important to periodically check the list of insured banks to ensure that your bank remains on the list. If your bank is removed from the list, it means your investment is no longer insured. In such a case, you may consider withdrawing your funds or exploring alternative banking options.

By following these steps and staying informed about the status of your bank’s insurance coverage, you can make informed decisions and ensure the safety of your bank deposits within the DICGC coverage limit.

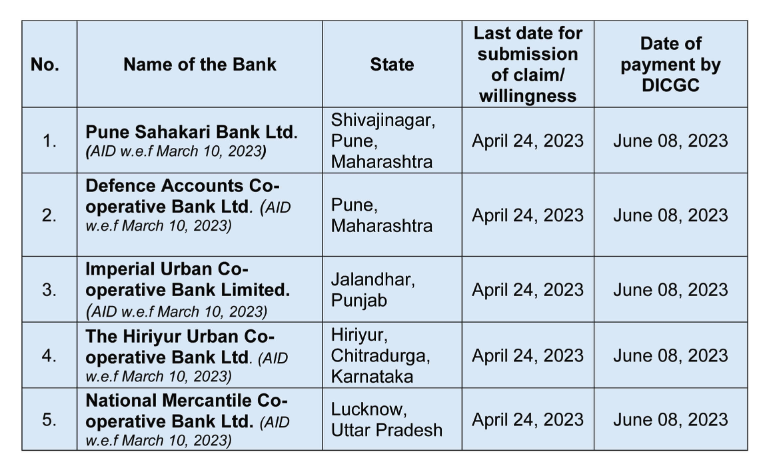

Small finance banks may offer higher interest rates on FDs compared to large banks, providing an opportunity for higher returns. However, the safety of your investment should be a top priority. By understanding the regulatory framework, DICGC coverage, and conducting thorough research, you can invest in small finance banks with confidence, knowing that your money is safe. Remember to diversify your investments and strike a balance between returns and risk to achieve your financial objectives. The following is the list of banks for which DICGC is currently processing payments.

In our next article, we will discuss strategies for investing more than ₹5 lakh while ensuring that all your investments are insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC).

[…] our initial discussion, Maximising Returns with Safety: Exploring the Safety of FDs in Small Finance Banks, we examined the benefits of placing fixed deposits (FDs) in small finance banks, highlighting […]